There are many reasons to buy gold and silver as insurance for one?s exposure to currency risk, but of the two major monetary metals, which one makes more sense to buy today, gold or silver? This article will analyze whether there should be a switch from gold to silver based on the current gold/silver ratio and other reasoning. Note: While there may be additional commissions to be paid, there would not be any capital gain or income tax for a move from gold to silver in one?s IRA. This type of move does not make sense for those with non-IRA (non-qualified) accounts as you do not receive the ?like kind? exchange?privilege?for gold and silver. Meaning, you can?t sell one metal for the other without incurring taxes on the capital gain like you can with Real Estate via a 1031 exchange. There could however be some tax losses one might want to take advantage of, as little as they are, but a CPA should be consulted in such cases. You also won?t be subject to the wash rule where you sell gold and not have to wait 30 days to buy it back as you are buying a different metal (silver) instead. Perhaps this type of move would make up for your tax increases Congress just gave everyone for a few years!

Gold/Silver Historical and Current Ratio Analysis

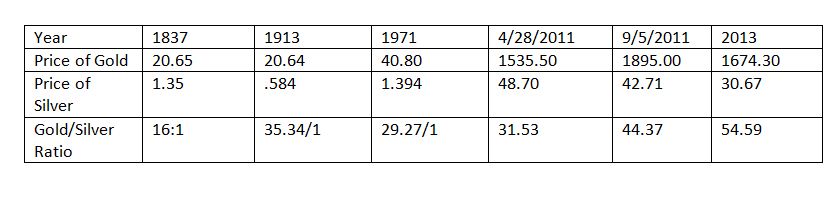

I know many in the pro-silver crowd will point to the 1792 ?ratio of ?15:1 or 1837 ratio of 16:1 set by Congress as a ?norm? to return to. I don?t fall into that camp. When the Federal Reserve came into existence, gold was priced at $20.64 an ounce and silver was $.584 an ounce for a ratio of 35.34/1. When President Nixon took us off the gold standard in 1971, the ratio has taken a turn in favor of gold slipping to 29.27/1 (Gold was priced at $40.80 and silver at $1.394). For this analysis, I will concentrate on the last 25 years of the ratio and ignore the gold price fixing period by our government which made the gold/silver ratio suspect at best.

Over the past 25 years the ratio has fluctuated from 31.53:1 to 98:1. Most recently it reached a high of 84.4:1 on October 17th, 2008 and fell to 66.7 in May of 2009 and has remained steady through June of 2010 where it hit 66.53. The ratio fell to 31.53 on April of 2011 when silver came close to it?s all-time high of $50 and rose to 44.37 when gold reached it?s all-time high on September 6, 2011. Today the gold/silver ratio sits at 54.59 with gold priced at $1674.30 and silver at $30.67. These various ratios can be seen graphically in the following table (prices from Kitco.com).

Can Current Ratios Predict Future Gold and Silver Price Action?

To answer this question, there are various factors to analyze for each metal, including; supply and demand, affordability, inflation/deflation, global trade, what the Indians are doing, what the Chinese are doing, what Europe is doing, what the Japanese are doing, what the Fed is doing, what Congress is doing, what large traders are doing, what the big banks are doing, what the CME is doing with margins, etc. etc.?Naturally there are many issues that can move the metals over the short term and none of us have a crystal ball. To make that kind of thorough analysis would take about 5 articles. I am trying to use just the gold/silver ratio and a few observations of what?s going on in the metals market with today?s article.?On a late note, don?t believe for a second what the Fed says about slowing things down on QE or any other program. They have to keep rates low or the consequences would be too severe. Just look at Europe as to what?s ahead. The Fed is involved there too. They are simply talking their game and getting the effect they want, for now.

Whether or not gold and silver are money is not the issue here. Gold and silver can be converted into the scrip of the day the same way stocks and bonds can. What the issue would be, if you believe in the reasons to own gold and silver, is which metal might offer you a better return? Both metals I believe will do well for one?s portfolio over the long term.

But if one used a little math, they might be able to come up with a good ratio to seek out in deciphering which metal to invest in, gold or silver, today or in the future.

Gold/Silver Ratio Math Observations?

In figuring out the proper gold/silver ratio I will only use the ratios from 1970 onward when gold was finally severed from government dictate as to value. I will use the ratio at the beginning of each decade and then weight it more heavily for the last decade. This I believe will provide an average ratio from which to trade from. Doing so, we get the following results.

As you can see from the table above, we are right at or near today?s gold/silver ratio average of 55.7 based on the above data and for the last 12 years, we have averaged almost exactly where we are with today?s ratio. I want to reiterate I am discounting the centuries old 16:1 ratio that Congress once provided. For me, that ratio is irrelevant for today. It may not be what gold bugs want to hear, but I call it like I see it.

What this data does mean, as I interpret it from an investment point of view, is for a recommendation of a 50/50 split between silver and gold for the conservative investor. ?For the ultra conservative investor, perhaps a retiree with an IRA, a 70% gold and 30% silver investment is just fine as silver is more volatile and can possibly shake the nerves of this type of investor as I?m sure it has for many since that $49.50 high in price of silver and subsequent fall.

I will say this from viewing the day to day prices for gold and silver, when I see the prices of the metals move higher on the same day (most of the time they do), silver moves higher faster today than gold on a percentage basis.?On Wednesday, January 2nd, silver was up just over 3% and gold rose about 1%. When silver finally does take the leap higher again, I believe we will have a repeat of the price move that culminated in silver almost reaching it?s all-time high. For gold to reach it?s all-time high from September, 2011 of around $900 it would rise 15%. For silver to reach its April 2011 high of $49.50 it would rise 67%.

For this reason I am ok with a 70% allocation to silver and 30% allocation to gold albeit I would do this on a dollar cost average basis as prices could still fall from here, especially if you are a more conservative investor. I would not have given this same advice if silver had done what it did in the beginning of 2011, but am fine with this advice today if one dollar cost averages in. You actually ?hope? the price falls further so you can accumulate more metal at a lower price. Of course you have to be convinced that the reason for owning the metals are sound as I do.

While I personally believe that owning physical gold and silver are the preferred way to invest, one can use ETFs like GLD, SLV and others to trade metals when these ratios hit extremes.

Dollar Moving Higher and Conclusion

The reasoning behind my thinking that prices could still fall from here is I am overall U.S. dollar bullish because I don?t believe the story about the Euro recovering and have been negative on the Yen Since March 2010 (although a little early). These two currencies make up 71.2% of the U.S. Dollar Index and ?perception? may be that the U.S. will be the last bastion of safety for those who live in the countries that utilize these currencies. What other choice do they have? Perhaps this is the reason why both the Republicans and Democrats keep spending so much on the Military. Again, perception. And here I thought it was ?possession? that was 9/10 of the law!

Indeed the dollar (see chart below) has moved up from its low of 79.283 on January 2nd to 80.646 by the next day?s evening and gold and silver both fell by 1.58% and 3.65% respectively, giving back all their post fiscal cliff returns and more. I do realize that many who sell gold talk about the falling dollar and blame Fed QE, Congress and Obama for failing to curtail debt. All of this means that the price of gold should be moving much higher. At times they have moved higher, but since September, they have been flirting with their 200 day moving averages and after Thursday?s drop, may break down for a bit as the dollar moves higher. In my upcoming 2013 predictions article I will address this more. My advice again for all gold and silver investors is to dollar cost average into a position which many of my clients have been doing the last year or so.

Eventually, gold and silver will naturally benefit from weakness in currencies from those countries whose currencies are declining at an increasing rate. There are only so many ounces of gold and silver above ground and being produced annually.

The gold/silver ratio can be used with all of your other tools in analyzing which metal might give you a better return. Can the ratio go back to 60, 70 or even 90 again? Anything is possible, but I would think based on historical ratios that the 60-70 range would be the extreme. The conservative investor can wait for this level to be reached if it gets there, or just stick with gold.

The reason in the opening paragraph why I called gold and silver insurance is because none of these countries governments I mentioned above or elsewhere in the world, including our country (U.S.), are going to take the necessary steps to fix their economies. They just aren?t serious about it. They could have reduced their debts and deficits when ?times were good,? but did they? All government do what they do best; spend. They spend your hard earned labor and when that?s not enough they have their Central Banks print more. And when some of their favored sons get in trouble, they collect more from you or print more to give to them. And when things don?t go their way, they ask others to participate in the same scheme like the Financial Accounting Standards Board (FASB) did a couple years ago in allowing banks the ability to not have to mark to market their assets but keep them on the books at the 2006/2007 market highs.

The list of problems for our government goes on and on and I must clarify one thing for those who don?t like precious metals at all. Please don?t pretend what governments are up to from a fiscal balance sheet analysis is not relevant to the discussion. All those of us who are in favor of investing in gold and silver want is a little insurance?.just in case governments aren?t right. Just in case governments fall over the?proverbial?cliff. I can?t tell you what the ratio of governments being right is, but I imagine it?s inverse of the gold to silver ratio (that would be right 1/55 times using today?s ratio).

?

?

Related posts

robert deniro mexico news the talented mr ripley weather new orleans orcl the hartford illinois primary 2012

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.